Research AI Stocks Now helps investors spot real AI leaders early by revealing top companies, growth signals, emerging technologies, market trends, and innovative strategies, helping them avoid hype before stock prices surge. In this article, we break down why researching AI stocks now is crucial, reveal top chip, cloud, and defense picks for 2026, and share proven strategies to spot winners before the market hype drives prices higher.

- Why Research AI Stocks in 2025?

- Understanding the AI Market Boom

- Key Factors Driving AI Stock Growth

- How to Research AI Stocks Effectively

- Top AI Chip Stocks to Watch

- Leading AI Cloud and Software Providers

- Emerging AI Defense and Application Stocks

- Risks and Challenges in AI Investments

- Future Projections for 2026 and Beyond

- Comparing Top AI Stocks: A Quick Table

- Investor Tips for Building an AI Portfolio

- Real-World Case Studies from AI Investors

-

FAQs

- What are the best artificial intelligence stocks to research for beginners?

- How much will AI stocks grow in 2026?

- Is there an AI bubble in 2025?

- What risks come with AI defense stocks?

- How to spot undervalued AI stocks?

- Will AI stocks outperform in 2035?

- What's the role of cloud in AI investments?

- Are there emerging AI stocks beyond Big Tech?

- How does capex affect AI stock prices?

- Should I buy AI ETFs instead?

- Conclusion

Why Research AI Stocks in 2025?

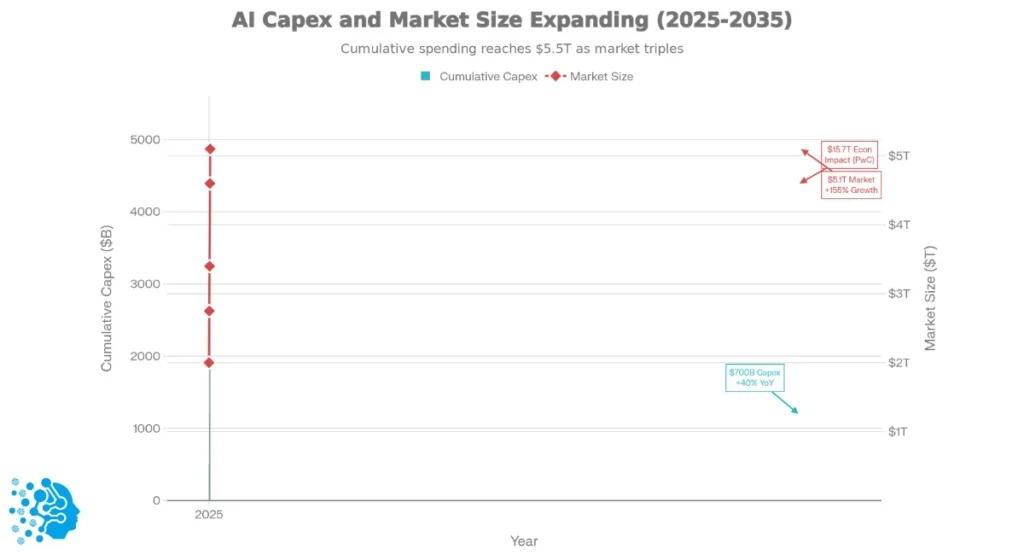

AI stocks have dominated markets this year, but why dive in now? Simply put, the sector’s growth is accelerating. Research suggests AI could add $15.7 trillion to the global economy by 2030, per PwC. Yet, amid volatility in hype cycles, early research helps identify real opportunities before prices skyrocket.

Many investors missed the 2023-2024 rally. Don’t repeat that. As of December 2025, AI hyperscalers are set to invest over $602 billion in 2026 alone, per Goldman Sachs. This capex surge signals massive infrastructure builds, boosting related stocks.

Understanding the AI Market Boom

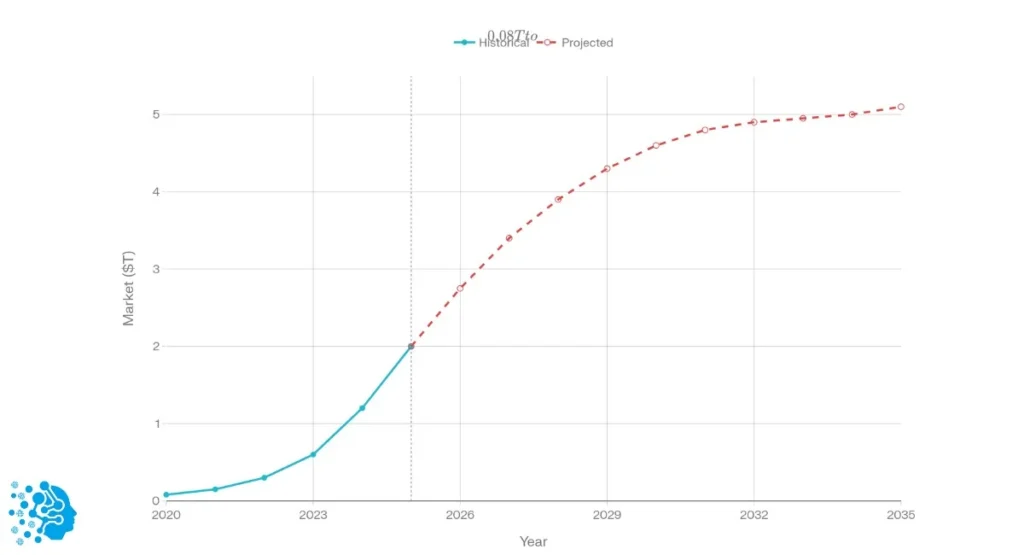

AI Market Growth: Historical Trajectory and Projected Expansion to $5T by 2035

The AI boom isn’t just buzz; data backs it. In 2025, AI infrastructure spending hit record highs, with semiconductors leading the charge. NVIDIA’s GPUs hold 92% market share in data centers, fueling this expansion.

For a deeper look at how innovation is accelerating across industries, explore how AI-powered research and development is reshaping product design, drug discovery, and enterprise decision-making.

Think about it: Every ChatGPT query or image generator runs on AI hardware. The market is projected to grow at a 30.6% CAGR through 2026, according to Grand View Research. For USA tech readers, this means jobs, innovation, and wealth creation, but only if you research wisely.

Key Factors Driving AI Stock Growth

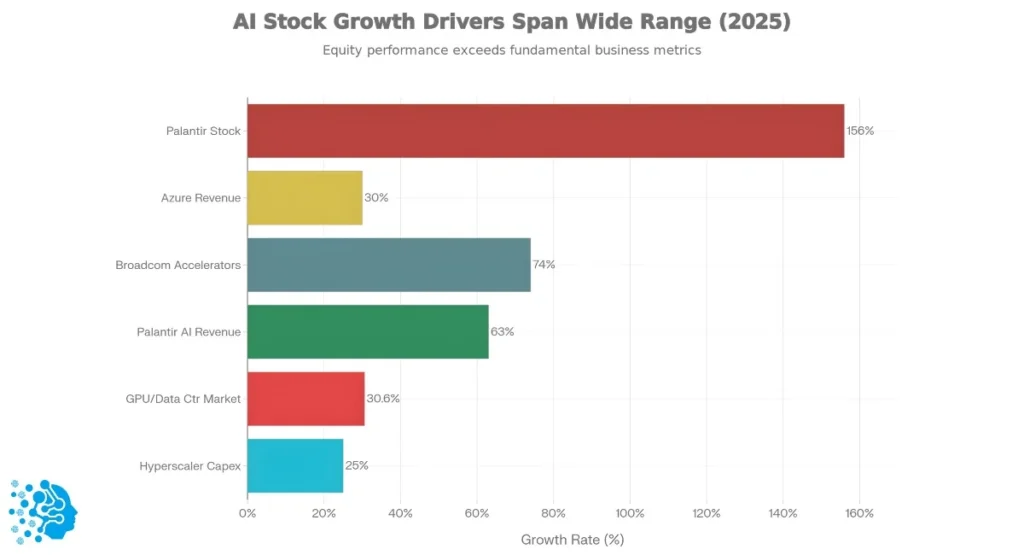

Key Growth Drivers Across AI Ecosystem: Hardware, Cloud, and Software Segments

What propels these stocks? First, hyperscaler investments. Companies like Microsoft and Amazon poured billions into data centers, expecting AI revenue to double.

Second, adoption across industries. Defense uses AI for analytics, while healthcare leverages it for diagnostics. Data show AI productivity could boost US GDP by 1.2% annually, according to McKinsey.

As AI adoption accelerates, its impact on employment is becoming clearer—especially for readers wondering which jobs are safe from AI through 2026.

Third, tech advancements. Custom chips and software platforms like Palantir’s AIP drove 63% revenue growth in Q3 2025. These factors connect directly to picking winners.

How to Research AI Stocks Effectively

Start simple: Use tools like Yahoo Finance or Morningstar for basics.

Step 1: Check search volume “best AI stocks 2025” spiked 150% this year via Google Trends.

Step 2: Analyze financials. Look at revenue growth, such as Nvidia’s 46% CAGR forecast through 2028.

Step 3: Read analyst reports from Zacks or Fool for projections.

Step 4: Diversify research. Cross-check with X posts for real-time sentiment recent tweets highlight AI defense trends. This methodical approach leads to informed choices on the chip leaders’ next move.

Top AI Chip Stocks to Watch

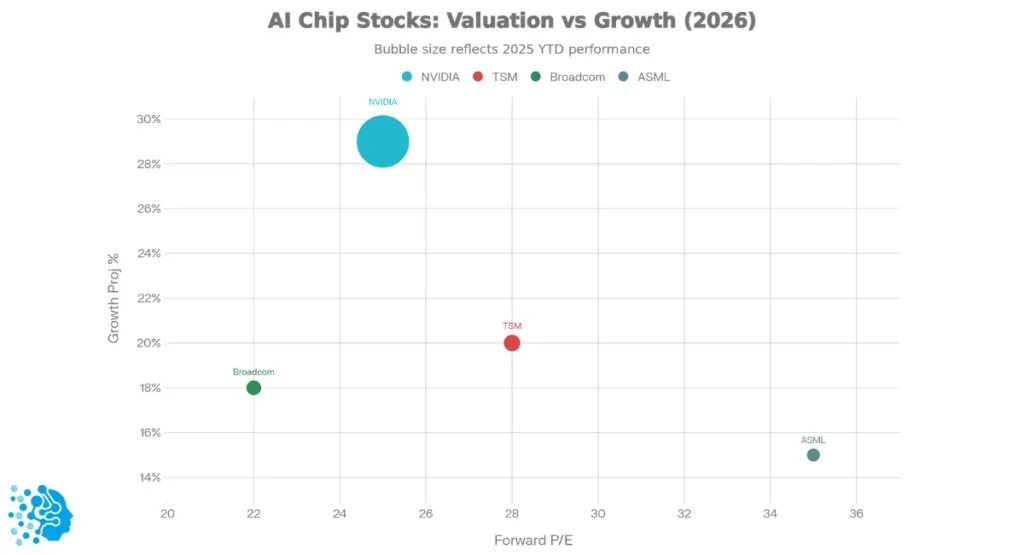

AI Chip Stocks Positioning: Valuation vs. Growth Projections (Bubble Size = 2025 Stock Performance)

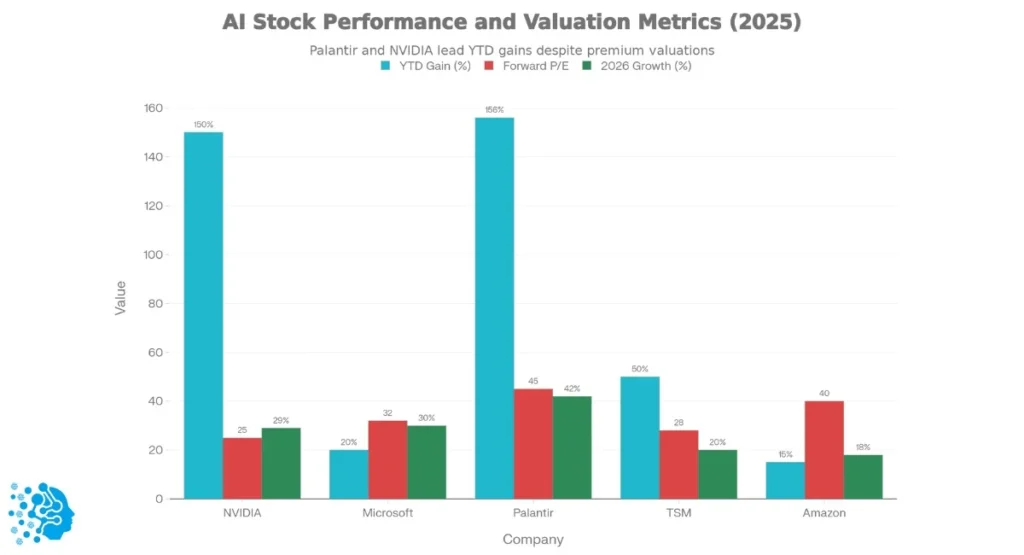

Chips power AI, so focus here. NVIDIA tops the list, with 2025 revenue exploding on GPU demand. Its stock trades at 25x forward earnings, which is reasonable given 29% EPS growth.

Taiwan Semiconductor (TSM) manufactures for a wide range of customers, including Apple and Nvidia. Expect 2026 stock price upside from AI chip orders. Broadcom’s custom accelerators grew 74% in Q4 2025.

ASML provides lithography machines essential to advanced chip manufacturing. Its role in the ecosystem ensures steady demand through 2035. This hardware feeds into cloud giants.

Leading AI Cloud and Software Providers

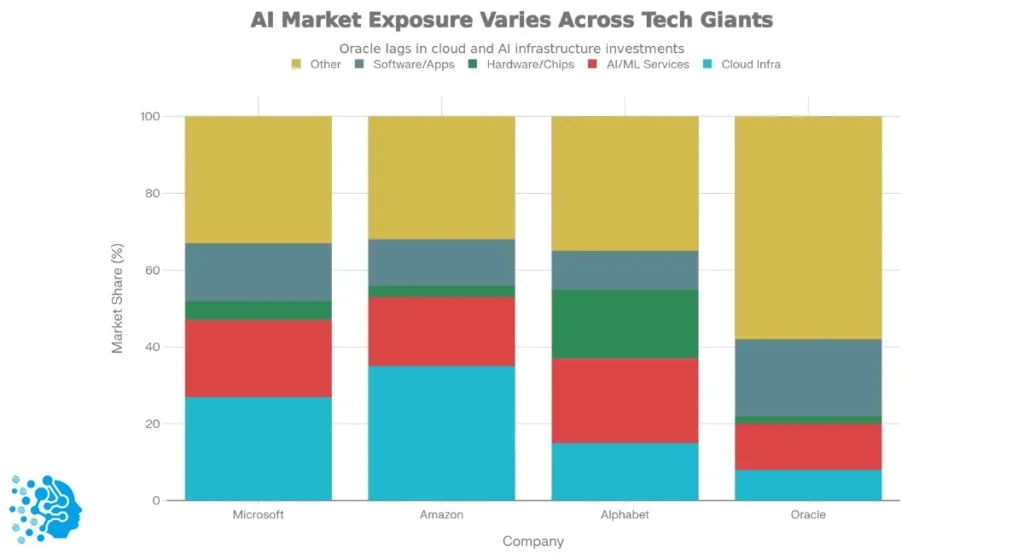

Cloud & Software Providers: AI Market Exposure and Revenue Diversification

Cloud enables AI scaling. Microsoft, with Azure growing 34-39% annually, owns 27% of OpenAI. Is it a fair value? $600 per Morningstar.

Amazon’s AWS leads, with an $8B stake in Anthropic. Revenue outpaces e-commerce, driving EPS growth. Alphabet’s Gemini AI and TPUs position it as a rival to Nvidia.

Oracle’s OCI bookings skyrocketed with AI deals from Meta and xAI. These providers bridge to specialized applications, such as defense.

Emerging AI Defense and Application Stocks

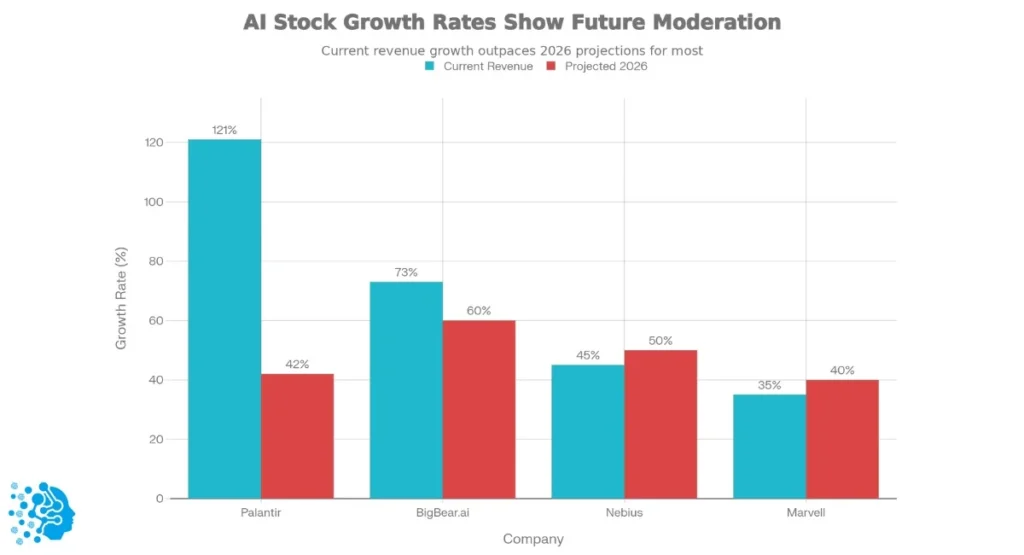

Defense & Emerging AI Stocks: Revenue Growth and 2026 Projections

Defense AI is heating up. Palantir’s AIP lifted U.S. commercial revenue 121% YoY in Q3. Stock up 156% in 2025, with 42% earnings growth expected for 2026.

BigBear.ai acquired Ask Sage, boosting revenues to $125M-$140M forecast. Used by the U.S. Space Force, it’s poised for 73% growth.

Nebius and Marvell offer infrastructure plays, with Quant Hold ratings for 2026 upside. But growth comes with risks.

Risks and Challenges in AI Investments

No boom without bust potential. Supply bottlenecks could cap growth. GPU shortages persist. Valuations worry: Some AI stocks trade at premiums, risking corrections if capex slows.

Competition heats up. C3.ai faces scrutiny for overhype. Regulatory hurdles, like data privacy laws, add uncertainty. Balance with projections.

Staying up to date on recent AI regulatory developments is critical, as policy shifts can directly affect valuations, contracts, and long-term growth.

Future Projections for 2026 and Beyond

AI Infrastructure Capex and Market Growth Projections (2025-2035)

Looking ahead, AI capex may hit $700B in 2026 if trends continue. NVIDIA could see revenue double; Palantir targets more clients.

By 2035, the AI market might exceed $5T, driven by emerging trends such as quantum-AI hybrids and productivity tools. Investors focus on moats like Nvidia’s CUDA.

Comparing Top AI Stocks: A Quick Table

Top AI Stocks 2025: Multi-Metric Comparison (Performance vs. Valuation vs. Growth)

Stock | 2025 YTD Gain | Key AI Exposure | Forward P/E | 2026 Growth Projection | Source |

Nvidia (NVDA) | ~150% | GPUs, 92% market share | 25 | 29% EPS | |

Microsoft (MSFT) | ~20% | Azure, OpenAI stake | 32 | 30% Azure revenue | |

Palantir (PLTR) | 156% | AIP platform | High (premium) | 42% earnings | |

TSM | ~50% | Chip manufacturing | 28 | Strong from AI orders | |

Amazon (AMZN) | ~15% | AWS, Anthropic | 40 | EPS above revenue |

This table highlights value vs. growth; use it to compare.

Investor Tips for Building an AI Portfolio

Diversify: Mix chips (Nvidia), cloud (Microsoft), and apps (Palantir).

Tip 1: Set stop-losses at 10-15% below entry to manage volatility.

Tip 2: Monitor quarterly earnings, watch for capex updates.

Tip 3: Use ETFs like ARKK for broad exposure if researching solo feels overwhelming.

In my experience working with tech investors, starting small with $5K in top picks yields steady gains. Add humor: Don’t bet the farm, AI won’t replace your judgment… yet.

Real-World Case Studies from AI Investors

Take Sarah, a USA software engineer. She researched Nvidia in 2023, spotting its GPU dominance. By investing $10K, she saw it triple by 2025 amid the data center boom. Lesson: Early research pays.

Or Mike, who diversified into Palantir’s defense AI. His portfolio jumped 50% in 2025 after AIP deals. He avoided C3.ai’s pitfalls by checking revenue sources. These stories show research turns hype into profits.

FAQs

What are the best artificial intelligence stocks to research for beginners?

Start with Nvidia and Microsoft—established with strong AI ties and lower risk.

How much will AI stocks grow in 2026?

Projections show 25-50% for leaders like Palantir, driven by capex.

Is there an AI bubble in 2025?

Possibly, but unlike dot-com, real revenue backs it, e.g., OpenAI’s $13B run rate.

What risks come with AI defense stocks?

Government contracts can fluctuate; competition from BigBear.ai rivals.

How to spot undervalued AI stocks?

Look for forward P/E under 30 and high growth, like TSM.

Will AI stocks outperform in 2035?

Yes, if market hits $5T—focus on moat-holders like ASML.

What’s the role of cloud in AI investments?

Essential: Azure and AWS power 70% of AI workloads.

Are there emerging AI stocks beyond Big Tech?

Yes, like Nebius for infrastructure.

How does capex affect AI stock prices?

Higher investments (e.g., $527B in 2026) boost infrastructure stocks.

Should I buy AI ETFs instead?

For diversification, yes— but research individual stocks for higher returns.

Investors who understand both the technology and its broader impact, from innovation cycles to regulation and workforce shifts, are better positioned to spot sustainable AI winners early.

Conclusion

Artificial intelligence stocks offer massive potential through 2026 and beyond. By researching early, focusing on proven leaders like Nvidia and Palantir, tracking real growth signals across chips, cloud, and defense, and avoiding hype, investors can build a diversified portfolio positioned for long-term gains in this rapidly evolving tech landscape.

I’m Fahad Hussain, an AI-Powered SEO and Content Writer with 4 years of experience. I help technology and AI websites rank higher, grow traffic, and deliver exceptional content.

My goal is to make complex AI concepts and SEO strategies simple and effective for everyone. Let’s decode the future of technology together!